INVESTMENT STRATEGIES

ETF EDUCATION

EDUCATION

Investment Education

iShares ETFs & BlackRock Funds cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of these Funds for your investment objective, please visit our product webpages.

iShares ETFs & BlackRock Funds cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of these Funds for your investment objective, please visit our product webpages.

Find out more about iShares ETFs/BlackRock products:

https://www.blackrock.com/au/individual/products/investment-funds

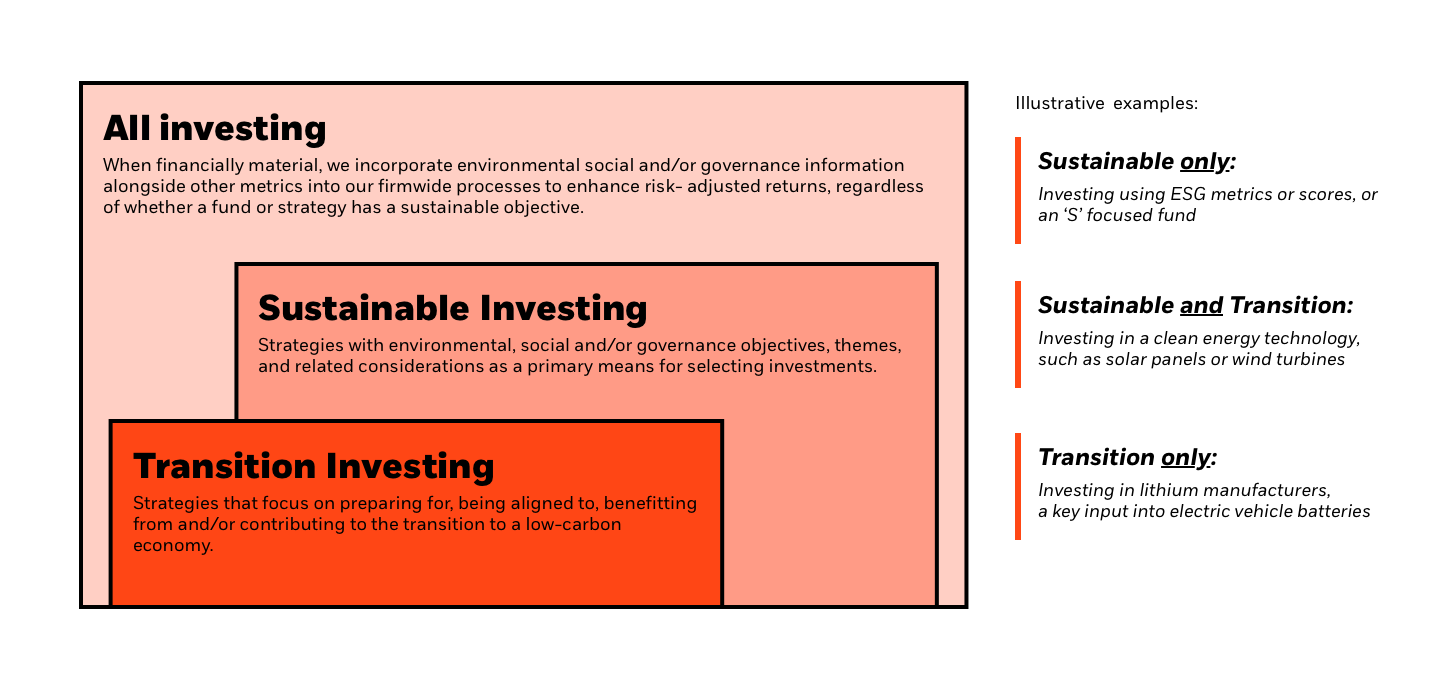

BlackRock’s approach to sustainable investing and the transition to a low-carbon economy is rooted in our fiduciary duty to clients. We start by understanding our clients’ investment objectives and provide choice to meet their needs; we seek the best risk-adjusted returns within the scope of mandates they give us; and we underpin our work with research, data, and analytics.

Sustainable investing refers to strategies which leverage environmental, social and/or governance (ESG) objectives, themes, and related considerations as a primary means for selecting investments.

The four categories of the BlackRock sustainable investing platform—Screened, Uplift, Thematic and Impact—adopt different strategies to help investors to meet their investment objectives.

Across the platform, products use environmental, social and / or governance data as a portfolio construction input and a subset of those products also seek to achieve long-term sustainability outcomes (in line with each product’s specific investment objective).

As of June 30, 2023 BlackRock offers over 400+ dedicated sustainable products and solutions across index and active platforms, with a combined USD$705B in sustainable assets under management.

| Screened | Uplift | Thematic | Impact | |

|---|---|---|---|---|

| Investment approach | Constrain investments by avoiding issuers or business activities with certain environmental, social and / or governance characteristics. | Commitment to investments with improved environmental, social and / or governance characteristics versus a stated universe or benchmark. | Targeted investments in issuers whose business models may not only benefit from but also may drive long-term sustainability outcomes. | Commitment to generate positive, measurable, and additional sustainability outcomes. |

| Additional details | Includes use of screens and may be enhanced with active engagement with specific issuers. | Environmental, social and / or governance data drives portfolio construction and security selection with some strategies leveraging to target a specific objective. | Strategy construction determined by focused exposure to the specific environmental or social theme. | Investment process must showcase “additionality” and “intentionality” in line with Operating Principles for Impact Management. |

To explore the sustainability characteristics of specific funds, visit the product pages of BlackRock.com or visit our product selector tool.

Source: BlackRock, September 2023. For illustrative purposes only. This graphic represents the relationship between sustainable investing and transition investing based on current AUM and may not be drawn to scale. For more information, please refer to our Firmwide ESG Integration Statement.

The transition to a low-carbon economy is among a handful of major structural shifts having the potential to rewire economies, sectors and businesses.

Today, not all sustainable strategies are transition, and not all transition strategies are sustainable. By understanding the relationship between these types of investing strategies, investors can identify the products and solutions that meet their objectives.

BlackRock defines transition investing as investing with a focus on preparing for, being aligned to, benefitting from and/or contributing to the transition to a low-carbon economy.

Structural shifts associated with the low-carbon transition – technological innovation, consumer and investor preferences for lower-carbon products, and shifts in government policies – are reshaping production and consumption and spurring capital investment.

Three forces are driving this economic transformation: 1

This is creating investment opportunities. For example, average annual spend in the energy system through 2050 is estimated to reach US$4 trillion per year, up from US$2.2 trillion over the last decade. 2,3

BlackRock partners with companies that are developing innovative solutions to transform industries. An example is our work on battery storage, which can act as backup power in times of strain or failure. We invest, on behalf of clients, in companies like Akaysha Energy, who are working to develop solutions to support existing energy systems.

We have been at the forefront of helping investors understand the impact of climate and sustainability risk on portfolios. Our team of in-house specialists, including sector specialists and climate scientists, are uncovering insights to power investments.

ESG stands for environmental, social, and governance and refers to specific considerations that can be used as part of investment decision-making.

Example of ESG information could include:

ESG integration is the practice of incorporating ESG information into investment decisions to help enhance risk-adjusted returns.

Regardless of whether a fund or strategy has a sustainable or ESG-specific objective, BlackRock incorporates financially material ESG data or information alongside other information into our firmwide processes, with the objective of enhancing risk-adjusted returns of our clients’ portfolios.

BlackRock has a framework for ESG integration that permits a diversity of approaches across different investment teams, strategies and particular client mandates. As with other investment risks and opportunities, in our active and advisory strategies, the financial materiality of ESG considerations may vary by issuer, sector, product, mandate, and time horizon. Depending on the investment approach, financially material ESG data or information may help inform the due diligence, portfolio or index construction, and/or monitoring processes of our portfolios, as well as our approach to risk management.

In index portfolios, the investment objective is to track a predetermined benchmark index. BlackRock engages with third-party index providers to provide input on the design of their benchmark indexes, including benchmark indexes that take into account sustainability-related characteristics, in order to meet client demands and regulatory requirements.

For more detail, refer to BlackRock’s ESG Integration Statement.

Investment Stewardship is part of how BlackRock fulfils its fiduciary responsibility to our clients to advance their long-term economic interests. We do this through engaging with the companies our clients are invested in, voting proxies for those clients who have given us authority, and encouraging sound corporate governance and business practices as an informed, engaged investor.

In our experience, companies that effectively manage material risks and opportunities in their business models, including those related to sustainability, are better positioned to deliver durable, long-term financial performance. High standards of corporate governance, and strong boardroom and executive leadership, enable companies to be resilient and adaptable through macroeconomic and societal challenges that can impact their financial performance over time.

Our team spans the globe, assembling one of the largest, most diverse, and skilled investment stewardship teams in the industry.

The Sustainable and Transition Solutions team provide our firm and our clients with a clear picture of the relationship between sustainability issues, risk and long-term financial performance. The team drives the firm-wide development and adoption of sustainable investment practices, analytics, and products in line with our public sustainability commitments and fiduciary duty.