WHAT IS A BOND ETF?

A bond, or fixed income, ETF is a collection of individual bonds that trades on exchange, making investing in fixed income simple and transparent, especially during periods of market volatility. Bond ETFs allow access to various segments of the domestic and international bond markets.

The growth of bond ETF investing highlights the three key benefits of ETFs—competitive performance, low-cost and liquidity — apply to bonds just as they do to equities.

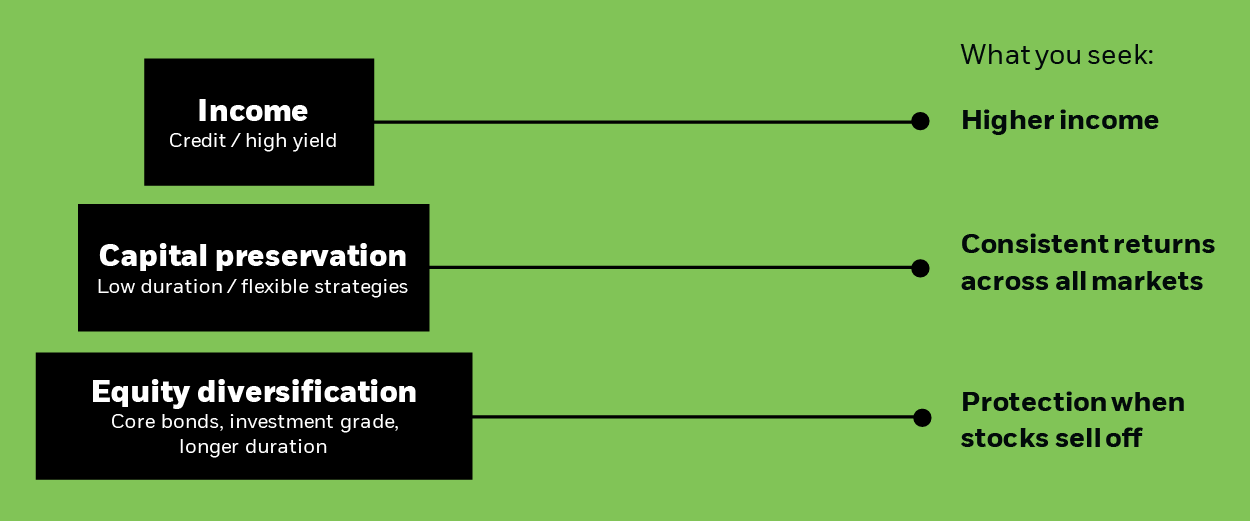

By using bond ETFs, investors can be increasingly nimble in their investment implementation process. Adding or subtracting exposures through bond ETFs can help build highly specific and advanced exposures, helping to better calibrate investor objectives such a pursuing income, preserving capital or diversifying away from equity.