The 2023 ASX Australian Investor Study shows that while 58% of Australian investors invest in domestic shares, only 16% invest directly in international shares. In other words, Australians exhibit a high degree of home bias when it comes to investing.1

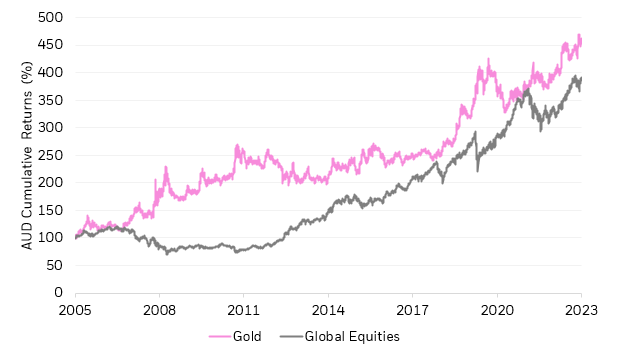

This is where unhedged gold can help shine a light in your portfolio. In the foreign exchange market, gold is bought and sold in USD. As such, an allocation to gold helps add diversification to the average Australian investor’s portfolio.2

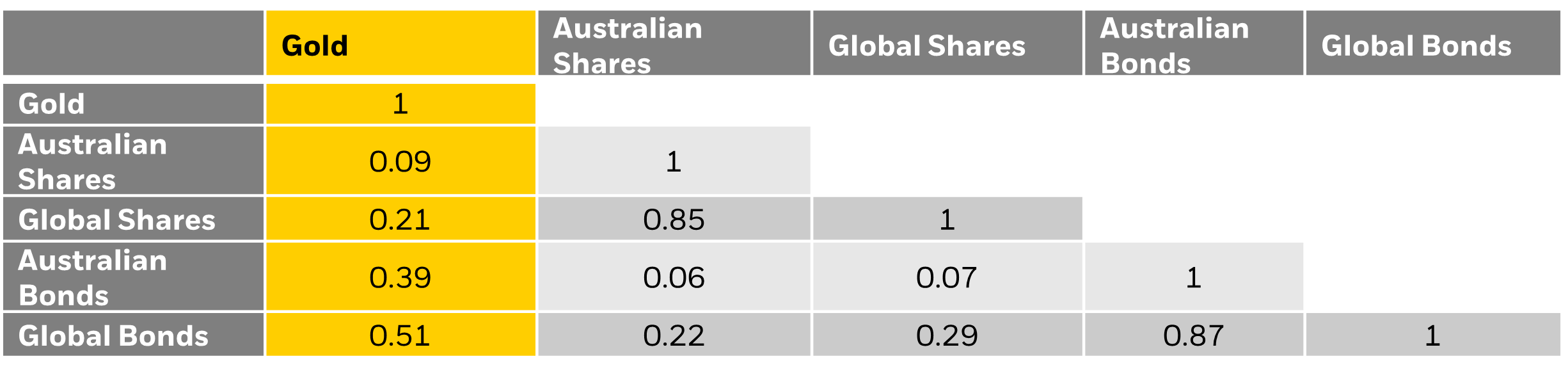

Diversification isn’t simply about having a range of different securities and assets in your portfolio. It’s about having securities that respond differently to the same factors or market situations such that if one security or asset class performs negatively, the other securities or asset classes could potentially cushion some of those losses. A low correlation means that securities or asset classes have relatively different reactions to the same factors, whilst a higher correlation means they generally behave quite similarly in most scenarios.

As illustrated below, gold has a low correlation with Australian and global shares and bonds. This means assets like gold can serve as a good diversifier to provide additional ballast for your portfolio.