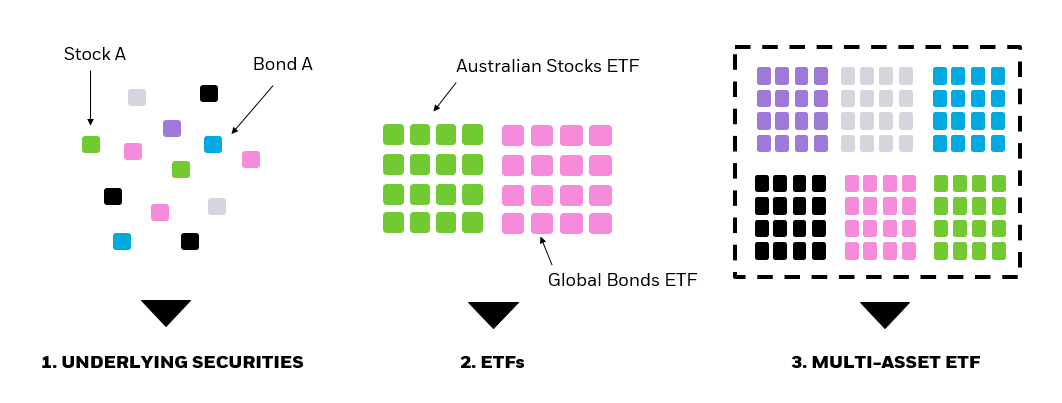

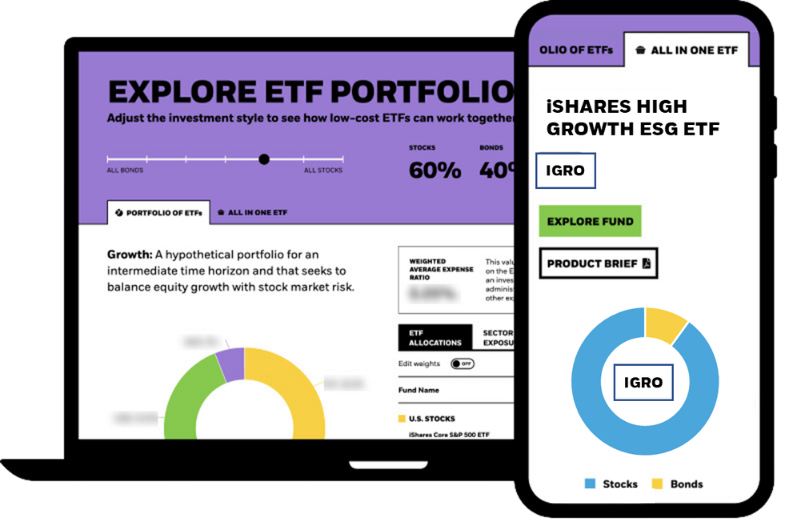

What are multi-asset ETFs? Multi-asset ETFs – also known as portfolio ETFs - invest in different types of assets such as bonds and equities to create a broadly diversified investment portfolio, all within a single ETF. This is done by investing in a few different ETFs to create an investment portfolio, effectively a fund of ETFs. With just one simple and cost-effective transaction, you can invest in a diversified portfolio across a broad range of asset types that aim for long-term risk-adjusted returns.

How are multi-asset ETFs different from other ETFs? Most ETFs aim to track the performance of a particular index, say the ASX 200. They do this by holding the underlying stocks that make up that index and weighted accordingly. Multi-asset ETFs, on the other hand, tend to be goals focused rather than track the performance of an index. For example, they might look to produce income, generate growth, or give exposure to a broad set of industries or themes that a single ETF may not be able to access.

What investments go into a multi-asset ETF? Putting together a portfolio of ETFs, or any investment portfolio for that matter, broadly depends on two considerations: firstly, what do you want from your investment – growth, or income, or exposure to sustainable investments, for example? And second, what level of risk are you prepared to take for the outcome you want.

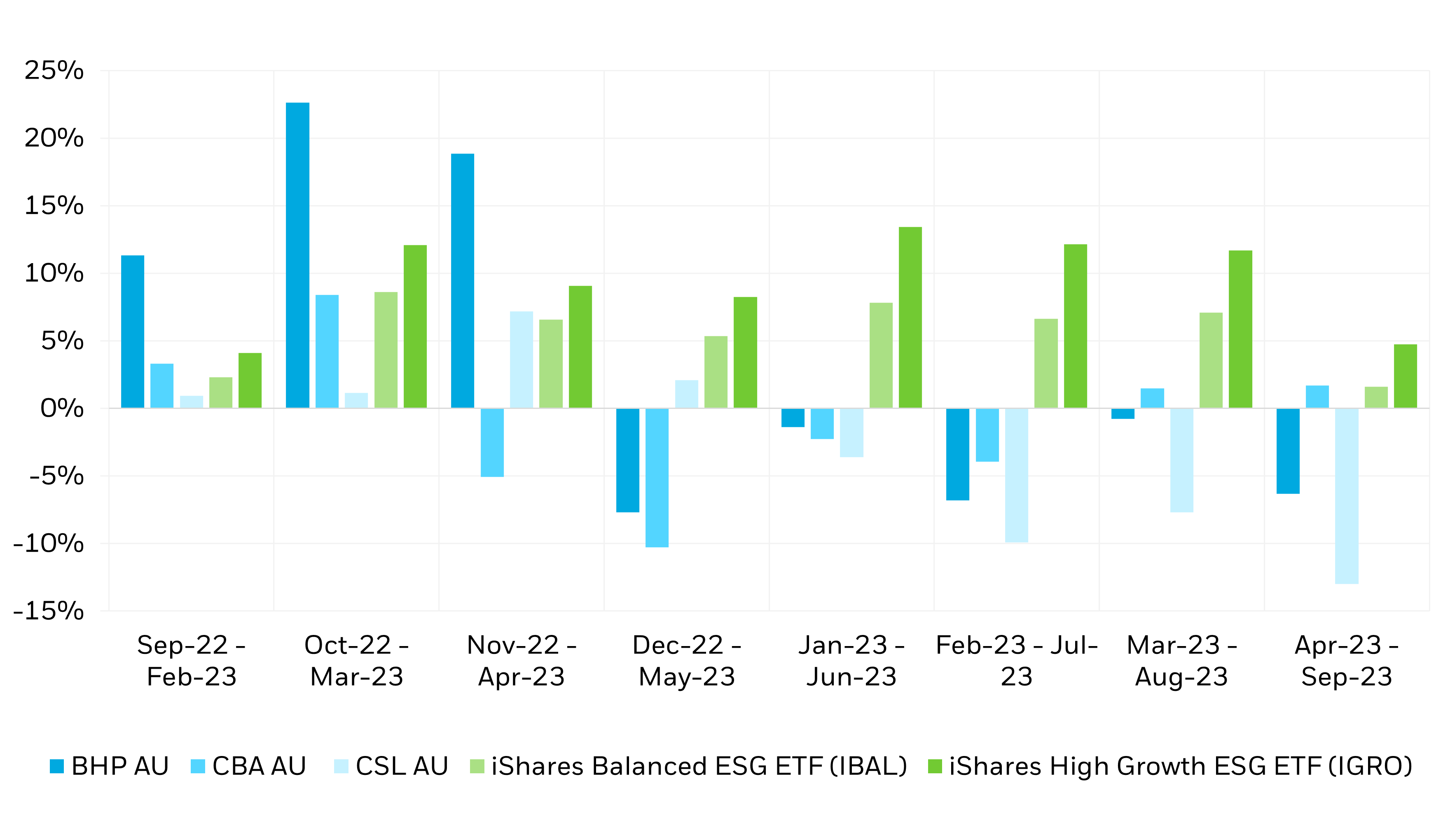

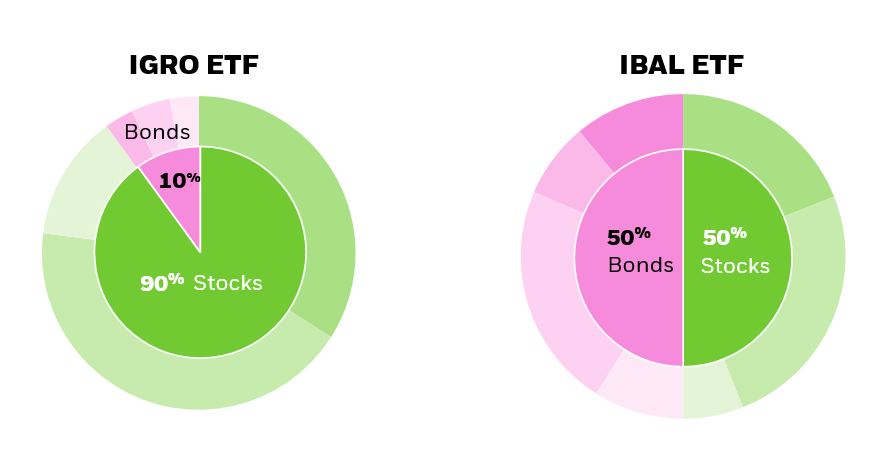

As with any investment portfolio, each asset class in the ETF contributes in a different way. Equities primarily focus on capital growth whilst bonds aim to generate an income. The mix of equities and bonds can have a big impact on the long-term returns as well as the level of risk in the portfolio.

Using BlackRock’s proprietary portfolio construction and risk methodology, we’ve built ETFs to provide some income, generate growth or access emerging trends, with an appropriate level of risk. Add to this, many of our multi-asset ETFs are sustainable which means they meet certain environmental, social and governance – or ESG – criteria.

What does sustainable investing and ESG mean?

ESG is the abbreviation for certain criteria relating to the environment (the E), social (the S) and corporate governance (and the G).

We see sustainable investing as the combination of traditional investment approaches with insights into environmental, social and governance (ESG) factors. We are convinced that the increasing focus on sustainability will put the spotlight on companies that place ESG factors at the heart of their decisions. Taking ESG insights into account can help investors build more resilient portfolios with less volatile returns.

For more on sustainable investing please refer to our website at blackrock.com.au.

What are the benefits of investing in multi-asset ETFs?

BlackRock’s multi-asset ETFs are simple, diversified, and sustainable. With just one simple transaction, you can get instant diversification across different asset classes. All of BlackRock’s ASX listed multi-asset portfolios are designed to leverage ESG products where available while staying within a given risk profile.

BlackRock’s multi-asset ETFs are built using our proprietary portfolio construction and risk-management processes. This means the ETFs are managed by our expert team to ensure the best possible returns for a pre-defined level of risk.

You can have low-cost access to the financial markets, meaning you keep more of your returns.

To find out more please refer to our website at blackrock.com.au

Are there any downsides to multi-asset ETFs?

As with any investment you need to make sure a multi-asset ETF is appropriate for you, your circumstances, and the outcomes you want. And like any investment the value can go up as well as down.

To find out more, visit the website at BlackRock.com.au or speak to a financial adviser.