BlackRock Voting Choice

We are committed to a future where every investor - across investment vehicles and client types - can have the option to participate in the proxy voting process if they choose.

BlackRock's Investment Stewardship team is core to BlackRock's role as a fiduciary and asset manager. As stewards of our clients' assets, we are committed to constructive, long-term-focused engagement with the companies our clients are invested in.

Investment Stewardship is part of how BlackRock fulfils its fiduciary responsibility to our clients to advance their long-term economic interests. We do this through engaging with the companies our clients are invested in, voting proxies for those clients who have given us authority, and encouraging sound corporate governance and business practices as an informed, engaged investor. In our experience, companies that effectively manage material risks and opportunities in their business models, including those related to sustainability, are better positioned to deliver durable, long-term financial performance. High standards of corporate governance, and strong boardroom and executive leadership, enable companies to be resilient and adaptable through macroeconomic and societal challenges that can impact their financial performance over time.

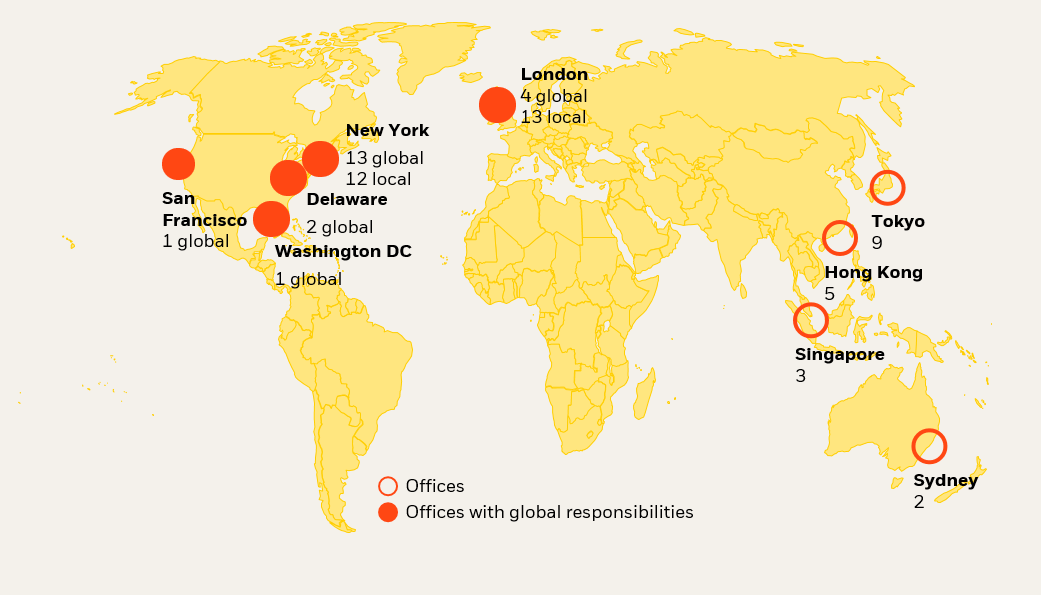

Our team spans the globe, assembling one of the largest, most diverse, and skilled investment stewardship teams in the industry.

Promoting sound corporate governance and resilient business models

Engagement is core to our stewardship efforts. Our engagement priorities reflect the five themes on which we most frequently engage companies, where they are relevant and a source of material business risk or opportunity.

Our investment stewardship efforts have always started with the board and executive leadership. The performance of the board is critical to the long-term financial success of a company and the protection of shareholders’ economic interests.

We engage on long-term corporate strategy, purpose and financial resilience to understand how boards and management are aligning their business decision-making with the company’s purpose and adjusting strategy and/or capital allocation plans as necessary as business dynamics change.

Financial resilience in a new economic regime

Executive compensation is an important tool to drive long-term financial value creation by incentivizing and rewarding the successful delivery of strategy goals and financial outperformance against peers. In our view, it is important for companies to make clear in their disclosures the connection between compensation policies and outcomes and the financial interests of long-term shareholders.

BIS engages with companies to better understand their approach to, and oversight of, material climate-related risks and opportunities as well as how they manage material natural capital impacts and dependencies, in the context of their business model and sector.

Read more on climate-related risk

Our participation in Climate Action 100+

In our experience, companies that invest in the relationships that are critical to their ability to meet their strategic objectives are more likely to deliver durable, long-term financial performance. By contrast, poor relationships may create adverse impacts that could expose companies to legal, regulatory, operational, and reputational risks.

BIS had 4,000+ engagements with companies during the 2022-23 proxy year

BIS engaged with 2,640+ unique companies across 49 markets during the 2022-23 proxy year

BIS voted at 18,200+ shareholder meetings during the 2022-23 proxy year

Out of the 171,500 proposals BIS voted on during the 2022-23 proxy year, less than 1% were shareholder proposals

Source: BlackRock. Sourced on August 18, 2023, reflecting data from July 1, 2022, through June 30, 2023.

We are committed to a future where every investor - across investment vehicles and client types - can have the option to participate in the proxy voting process if they choose.

We are committed to transparency in our investment stewardship activities. It is important to us that our clients understand how the work we do on their behalf aligns with their economic interests. Below is a library of our policies, reports, thought leadership pieces, and vote bulletins.

To request an engagement please submit a request through CorpAxe

For all other inquiries please contact the team at [email protected]

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf

Download pdf